2024 Fed Tax Standard Deduction For Seniors

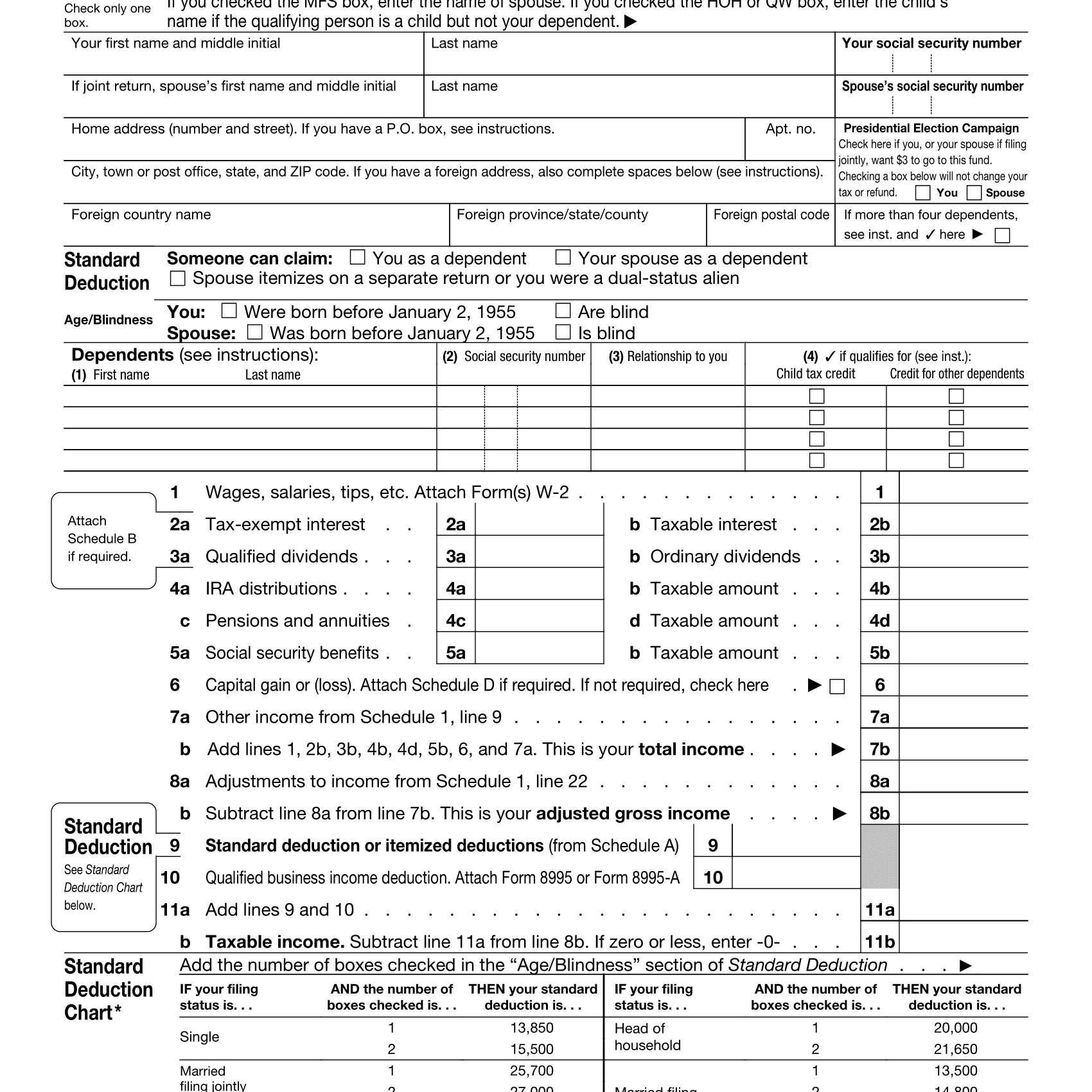

2024 Fed Tax Standard Deduction For Seniors. If you or your spouse were age 65 or older or blind at the end of the year, be sure to claim an additional standard deduction by checking the appropriate boxes for age or blindness on form 1040, u.s. Section 194p is applicable from 1st april 2021.

For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2024, an increase of $750 from 2023; The additional standard deduction amount for 2024 (returns usually filed in early 2025) is $1,550 ($1,950 if unmarried and not a surviving spouse).

If You Are 65 Or Older And Blind, The Extra Standard Deduction Is:

As your income goes up, the tax rate on the next layer of income is higher.

The Standard Deduction Amounts Will Increase To $14,600 For Individuals And Married Couples Filing Separately, Representing An Increase Of $750 From 2023.

Standard deduction limit in budget 2024:

2024 Fed Tax Standard Deduction For Seniors Images References :

Source: kellinawcalley.pages.dev

Source: kellinawcalley.pages.dev

2024 Tax Brackets And Deductions For Seniors Britte Maurizia, The standard deduction rose in 2024. 2024 standard deduction over 65.

Source: oliviewmerle.pages.dev

Source: oliviewmerle.pages.dev

What Is The 2024 Federal Standard Deduction For Seniors Nomi Tallou, Also, standard deduction limit for family. Tax rates report, giving you an early look at what brackets and other key tax figures will look like in 2024.

2024 Standard Deduction For Seniors Over 65 Gerri Juanita, $3,000 per qualifying individual if you are married, filing jointly. In total, a married couple 65 or older would have a standard deduction of $32,300.

Source: rebeblaverne.pages.dev

Source: rebeblaverne.pages.dev

Irs 2024 Standard Deductions And Tax Brackets Meade Scarlet, In addition, taxpayers who are age 65 and older, as well as those who are blind, can claim an additional $1,550 in 2024. For 2024, that extra standard deduction is $1,950 if you are single or file as head of household.

Source: godivamadlin.pages.dev

Source: godivamadlin.pages.dev

Standard Deduction 2024 For Seniors Over 65 Adara Annnora, The finance minister has announced changes in the standard deduction limit. Once the specified bank, as mentioned above, deducts tax for senior citizens above 75 years of age, there will be no requirement to furnish income tax returns by senior citizens.

Source: randenewetti.pages.dev

Source: randenewetti.pages.dev

2024 Standard Tax Deduction For Seniors Over 60 Rey Lenore, The standard deduction for a single person will go up from $13,850 in 2023 to $14,600 in 2024, an increase of 5.4%. You can take the standard deduction or you can itemize your deductions.

Source: sheelaghwbabara.pages.dev

Source: sheelaghwbabara.pages.dev

Standard Deduction 2024 Age 65 Dody Nadine, For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2024, an increase of $750 from 2023; Tax rates report, giving you an early look at what brackets and other key tax figures will look like in 2024.

Source: utaqkassie.pages.dev

Source: utaqkassie.pages.dev

Standard Deduction For Seniors 2024 Gabi Pammie, The standard deduction for a single person will go up from $13,850 in 2023 to $14,600 in 2024, an increase of 5.4%. The standard deduction amount depends on your filing status, whether you are 65 or older or blind, and whether another taxpayer can claim you as a dependent.

Source: charmainewkarla.pages.dev

Source: charmainewkarla.pages.dev

Standard Deduction 2024 Calculator Cari Rosanna, Seniors over age 65 may claim an additional standard deduction of $1,950 for single filers and $1,550 for joint filers. If you’re 65 or older and also blind, add $3,700 to $13,850 standard deduction.

Source: rosaliewviki.pages.dev

Source: rosaliewviki.pages.dev

What Is The Federal Standard Deduction For 2024 Sari Winnah, When you itemize deductions, you may have to provide proof that you had those expenses. Tax rates report, giving you an early look at what brackets and other key tax figures will look like in 2024.

The Standard Deduction For Salaried Employees Is Proposed To Be Increased From.

Section 194p is applicable from 1st april 2021.

Additionally, For Family Pension Income, The Deduction Under Section 57 Will Rise From ₹15,000 To ₹25,000.

Updated jun 20, 2024 written by sabrina parys

Posted in 2024